For a long time, people often compare India with China. They’re both emerging countries. But India is no China, and Brazil's no Russia.

They've never been all that similar, really. In fact, Standard & Poor's recently questioned "whether the BRIC [Brazil, Russia, India, China] countries ever shared much in common, other than scale and high portfolio inflows."

Well, of course they didn't. If you fall for the idea that countries are interchangeable while investing, you'll get burned.

What’s the common

As investors, we like to group things together. It simplifies complex information and gives us a way to make complicated decisions. And when it comes to international investing, it's convention to lump countries into one of two categories: developed markets vs. emerging markets.

The exact distinction is hazy. Former Secretary-General of the U.N. Kofi Annan defines a developed market as "one that allows all its citizens to enjoy a free and healthy life in a safe environment." Political scientist Ian Bremmer defines an emerging market as "a country where politics matters at least as much as economics to the markets."

Basically, to be considered developed, a country needs a high standard of living that isn't continually threatened by political crisis. Besides the United States, think of countries such as Japan, France, and Australia.

The emerging markets are then split into the BRIC countries -- a term coined less than a decade ago by Goldman Sachs, because it was sexy to bundle together the four emerging-market countries that combined size with tremendous growth prospects -- and everyone else (countries such as Peru, Turkey, Egypt, and Thailand).

The difference!

All of that splitting and grouping gives investors the false sense that the BRIC countries are essentially interchangeable: emerging, large, poised for growth.

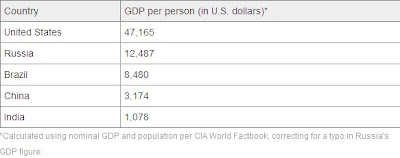

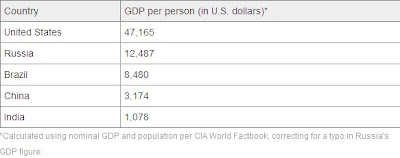

Even basic country data demonstrates just how large this fallacy is:

They've never been all that similar, really. In fact, Standard & Poor's recently questioned "whether the BRIC [Brazil, Russia, India, China] countries ever shared much in common, other than scale and high portfolio inflows."

Well, of course they didn't. If you fall for the idea that countries are interchangeable while investing, you'll get burned.

What’s the common

As investors, we like to group things together. It simplifies complex information and gives us a way to make complicated decisions. And when it comes to international investing, it's convention to lump countries into one of two categories: developed markets vs. emerging markets.

The exact distinction is hazy. Former Secretary-General of the U.N. Kofi Annan defines a developed market as "one that allows all its citizens to enjoy a free and healthy life in a safe environment." Political scientist Ian Bremmer defines an emerging market as "a country where politics matters at least as much as economics to the markets."

Basically, to be considered developed, a country needs a high standard of living that isn't continually threatened by political crisis. Besides the United States, think of countries such as Japan, France, and Australia.

The emerging markets are then split into the BRIC countries -- a term coined less than a decade ago by Goldman Sachs, because it was sexy to bundle together the four emerging-market countries that combined size with tremendous growth prospects -- and everyone else (countries such as Peru, Turkey, Egypt, and Thailand).

The difference!

All of that splitting and grouping gives investors the false sense that the BRIC countries are essentially interchangeable: emerging, large, poised for growth.

Even basic country data demonstrates just how large this fallacy is:

Gross domestic product (GDP) per person is one way to gauge the standard of living and productivity of a country -- and they demonstrate just how different these countries really are.

Yes, the emerging markets are quite different from the developed market -- the U.S.'s GDP per person is more than 40 times greater than India's -- but the chart also shows the great disparity among the BRIC countries. Russia is almost 12 times as prosperous as India, and even China is roughly three times so.

And this is just the economic disparity. You also have to factor in the country's political situation, overall economic stability, market conditions, cultural differences, and still more economic data such as national debt, balance of trade, inflation, savings rates, etc.

In other words, in international investing, country differences are at least as important as company differences -- because any potential that company has depends upon the context of its location.

For example, even though they're both companies that deal in global commodities, it could be argued that Vale (NYSE: RIO) is more closely linked to its fellow Brazilian Petroleo Brasileiro (NYSE: PBR) than it is to Aluminum Corp. of China (NYSE: ACH) -- aka Chinalco. In a more extreme example, Chinalco may be more closely linked to Chinese search engine Baidu (Nasdaq: BIDU) than it is to Vale.

Why? Because country-specific considerations frequently outweigh industry-specific considerations. Ask any company that has been subject to onerous regulation, excessive taxation, a devalued currency, or nationalization by its home country.

If this is true for a company like Vale, whose prices are dictated by global commodities demand, it's even more true for a company like Toyota (NYSE: TM), which relies on demand from its home country for more than half of its revenue.

What does this mean for investors?

**The substantial differences between countries -- not to mention between developed and emerging economies -- lead to three takeaways.

**Because of the addition of tricky country-specific dynamics, diversification may be even more important in international investing than it is in domestic investing.

**Emerging markets demand a greater risk premium than their developed brethren. In other words, you should demand a larger margin of safety (and lower earnings multiples) for companies in emerging markets.

**It isn't enough just to pore over the financial statements of a company and its competitors. Knowledge of a company's country is just as important as knowledge of the company itself.

No comments:

Post a Comment